Veterinary Medicine Market: Trends, Growth, overview and Future Prospects

The global veterinary medicine market is experiencing steady growth, with an estimated value of $45 billion in 2023 and expected to surpass $70 billion by 2030

1. Introduction

The veterinary medicine market is a rapidly growing sector, driven by increasing pet ownership, advancements in animal healthcare, and a rising demand for livestock productivity. The industry encompasses a wide range of products, including pharmaceuticals, vaccines, feed additives, and diagnostic tools, all aimed at maintaining animal health and preventing diseases.

With the humanization of pets and a growing awareness of zoonotic diseases, veterinary medicine has become more critical than ever. This article explores the market dynamics, key growth drivers, challenges, and future opportunities in the veterinary medicine industry.

2. Market Overview

Definition and Scope

Veterinary medicine refers to the science of diagnosing, treating, and preventing diseases in animals. It includes pharmaceutical drugs, vaccines, and other healthcare products that ensure the well-being of both companion animals (pets) and livestock (farm animals).

Key Components of Veterinary Medicine

The veterinary medicine industry is broadly classified into:

- Pharmaceuticals – Antibiotics, anti-inflammatory drugs, parasiticides

- Vaccines – Preventive immunizations for infectious diseases

- Feed Additives – Supplements to improve animal health and growth

- Diagnostics – Equipment and tests for disease detection

Market Segmentation by Animal Type

- Companion Animals: Dogs, cats, and exotic pets

- Livestock: Cattle, poultry, swine, and aquaculture

The demand for veterinary medicines is growing due to increased pet ownership and higher meat consumption worldwide, making it a lucrative industry for pharmaceutical companies and investors.

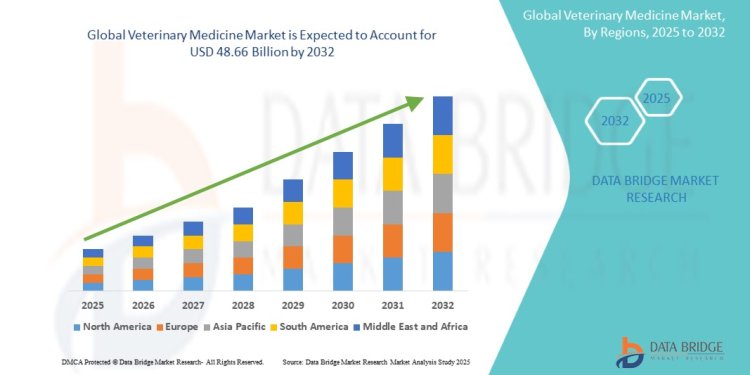

3. Market Size and Growth Trends

The global veterinary medicine market is experiencing steady growth, with an estimated value of $45 billion in 2023 and expected to surpass $70 billion by 2030. This growth is fueled by:

- Rising awareness about pet healthcare

- Increased government initiatives for livestock disease control

- Technological advancements in veterinary diagnostics and treatment

According to market research, the compound annual growth rate (CAGR) is expected to be around 7-9% during the forecast period. Developing regions like Asia-Pacific and Latin America are emerging as key markets due to their expanding agricultural sectors and rising disposable incomes.

4. Key Market Drivers

Several factors contribute to the rapid growth of the veterinary medicine market:

1. Increasing Pet Ownership and Humanization of Pets

More people treat their pets as family members, leading to increased spending on veterinary care, including medications, surgeries, and wellness treatments.

2. Rising Incidence of Zoonotic Diseases

Diseases transmitted from animals to humans (e.g., rabies, avian flu) highlight the need for effective veterinary interventions, prompting government and private sector investment in veterinary medicine.

3. Advancements in Veterinary Pharmaceuticals and Biotechnology

Innovations in gene therapy, biologics, and targeted drug delivery systems are transforming the industry. Companies are developing next-generation vaccines and AI-powered diagnostic tools to improve animal healthcare.

4. Growth in Livestock Production

With the rising global population, the demand for meat, dairy, and poultry products is increasing, necessitating the use of veterinary medicines to prevent diseases and enhance animal productivity.

5. Challenges Facing the Veterinary Medicine Market

While the industry is growing, several challenges hinder its expansion:

1. High Costs of Veterinary Drugs and Treatments

Veterinary medicines are expensive, making them unaffordable for many pet owners and farmers. The high cost of R&D, clinical trials, and regulatory approvals adds to the price burden.

2. Stringent Regulatory Framework

Approval processes for veterinary drugs are complex and time-consuming, with strict regulations imposed by bodies like the FDA, EMA, and WHO.

3. Shortage of Skilled Veterinary Professionals

There is a global shortage of veterinarians, particularly in rural areas. This affects the availability of quality veterinary care.

4. Growing Concerns Over Antimicrobial Resistance (AMR)

The overuse of antibiotics in animals is leading to antimicrobial resistance, raising concerns about the effectiveness of existing treatments. Governments are now enforcing stricter regulations to curb antibiotic misuse.

6. Market Segmentation

To better understand the veterinary medicine market, it is divided into several segments based on product type, animal type, and end-user.

By Product Type

- Pharmaceuticals – Antibiotics, anti-inflammatories, pain management drugs, and anti-parasitic drugs.

- Vaccines – Live, inactivated, toxoid, and recombinant vaccines.

- Feed Additives – Nutritional supplements, probiotics, and growth enhancers.

- Diagnostics – Rapid test kits, PCR testing, imaging solutions, and laboratory equipment.

By Animal Type

- Companion Animals: Dogs, cats, birds, rabbits, and exotic pets.

- Livestock Animals: Cattle, pigs, poultry, sheep, goats, and aquaculture.

By End-User

- Veterinary Hospitals & Clinics: Primary centers for animal healthcare.

- Research Institutions: Organizations working on animal health innovations.

- Retail Pharmacies: Over-the-counter (OTC) sales of pet and livestock medicines.

Understanding these segments helps pharmaceutical companies and healthcare providers tailor their products and services to specific market needs.

7. Competitive Landscape

Major Players in the Veterinary Medicine Market

The veterinary medicine industry is dominated by several global pharmaceutical companies, including:

- Zoetis Inc. – A leading manufacturer of veterinary pharmaceuticals and vaccines.

- Merck Animal Health – Known for its innovative animal healthcare solutions.

- Boehringer Ingelheim – Specializing in vaccines and parasite control products.

- Elanco Animal Health – A major player in pet and livestock pharmaceuticals.

- Ceva Santé Animale – Focuses on vaccines and reproduction control products.

Market Share and Competition

The market is highly competitive, with companies investing in research and development (R&D), strategic partnerships, and acquisitions to expand their product portfolio. The top 10 companies control over 60% of the market, making it challenging for new entrants.

Recent Mergers and Acquisitions

- Elanco acquired Bayer’s animal health division to strengthen its market position.

- Zoetis expanded its vaccine portfolio by acquiring new biotech firms.

- Merck partnered with AI-based diagnostic startups to enhance animal health monitoring.

These strategic moves highlight the market’s dynamic nature and the constant push for innovation.

8. Regional Analysis

North America

- The largest market for veterinary medicine due to high pet ownership and advanced veterinary healthcare infrastructure.

- The U.S. accounts for nearly 40% of global veterinary pharmaceutical sales.

- Strong presence of major pharmaceutical companies and regulatory support.

Europe

- Stringent regulations on animal healthcare and antibiotic usage.

- High awareness about pet health and livestock disease management.

- Countries like Germany, France, and the UK are leading markets.

Asia-Pacific

- Fastest-growing market due to rising demand for meat and dairy products.

- Increased pet adoption rates in countries like China, India, and Japan.

- Government initiatives to improve veterinary healthcare services.

Latin America & Middle East

- Growth driven by expanding livestock industries and increasing pet care expenditure.

- Brazil and Argentina lead the Latin American market, while the UAE and Saudi Arabia dominate the Middle East sector.

- Challenges include limited access to advanced veterinary services and low awareness.

9. Role of Biotechnology and Innovation

Gene Editing and Precision Medicine

- The use of CRISPR technology to create disease-resistant livestock.

- Customized treatment plans for pets based on genetic profiles.

AI and Big Data in Veterinary Diagnostics

- AI-powered imaging solutions for early disease detection.

- Smart wearables for continuous health monitoring in pets and farm animals.

Advancements in Vaccine Development

- Development of mRNA vaccines for animal diseases.

- Oral and intranasal vaccines for easier administration.

Biotechnology is revolutionizing veterinary medicine, paving the way for more effective and accessible treatments.

10. Impact of COVID-19 on the Veterinary Medicine Market

The COVID-19 pandemic had significant effects on the veterinary industry:

Supply Chain Disruptions

- Delays in drug manufacturing and distribution.

- Shortages of veterinary medicines and equipment.

Changes in Consumer Spending

- Reduced visits to veterinary clinics during lockdowns.

- Increase in online veterinary consultations and telemedicine services.

Long-Term Implications

- Shift towards e-commerce for pet medications and supplements.

- Greater focus on preventive healthcare for animals.

While the pandemic caused temporary setbacks, it also accelerated digital transformation in veterinary healthcare.

11. Regulations and Compliance in Veterinary Medicine

Key Regulatory Bodies

- FDA (U.S.) – Approves veterinary drugs and monitors safety standards.

- EMA (Europe) – Regulates animal health products in the European Union.

- WHO & OIE – Global organizations focusing on animal disease control.

Challenges in Compliance

- Lengthy approval processes for new veterinary drugs.

- Strict limitations on antibiotic use in livestock due to AMR concerns.

- Increased demand for organic and residue-free animal products.

Companies must navigate these regulations carefully to ensure product safety and market access.

12. Emerging Trends in Veterinary Medicine

Telemedicine in Veterinary Healthcare

- Growth of virtual vet consultations and online prescription services.

- Mobile apps for remote pet health monitoring.

Preventive Healthcare for Animals

- Rising popularity of pet insurance and wellness plans.

- Increased use of nutraceuticals and probiotics for overall health.

Personalized Medicine for Pets

- Use of DNA testing kits for breed-specific treatments.

- Tailored nutrition plans based on genetic markers.

These trends indicate a shift towards technology-driven and preventive approaches in animal healthcare.

browse more reports

https://www.databridgemarketresearch.com/reports/global-sigmoidoscopes-market

https://www.databridgemarketresearch.com/reports/global-deadbolt-smart-lock-market

https://www.databridgemarketresearch.com/reports/global-shrink-bags-market

https://www.databridgemarketresearch.com/reports/global-lithography-equipment-market

https://www.databridgemarketresearch.com/reports/global-myofascial-pain-syndrome-mps-treatment-market

What's Your Reaction?